4. THIS LAND IS MY LAND

RECALL THE STORY that opened this book, of Dennis Hastert's $10 million gain during his speakership. Unlike many of his colleagues, Hastert was never much of a stock trader. So how exactly did he do it?

By following George Washington Plunkitt's lead, in the form of a land deal. For Plunkitt, this entailed buying up land that he knew the government would need to purchase in the not too distant future and then selling it to the government for a healthy profit. Today, such a blatant move would appear too crude. Yet the land deal survives in disguised form. The Permanent Political Class has become more sophisticated in how it enriches itself by mixing real estate investments with taxpayer money. It is completely legal. Indeed, congressional ethics committees have even deemed it 'ethical.' And land deals are easier to camouflage than stock transactions. You can be fuzzy about the location of the property, and since there is no set price for the land, as there is for shares of stock, you can mask your profits more easily.

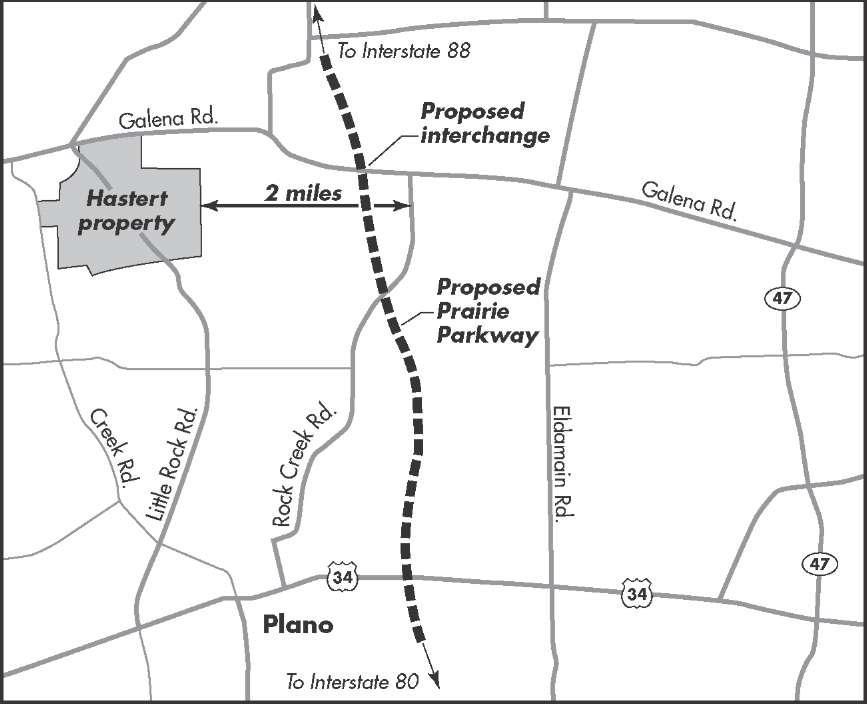

In 2002, Hastert bought a 195-acre farm on Little Rock Creek, in Kendall County, Illinois. He purchased it in July, just before the state's transportation secretary, Kirk Brown, approved the design of a land corridor for a road called the Prairie Parkway, on July 31. The farm was just 2.4 miles from the parkway corridor and 5 miles from the nearest proposed highway interchange. In February 2004, Hastert and two partners made a second land purchase. They formed a trust and bought another 69 acres right by the interchange in Plano, Illinois. They paid $15,000 an acre. Hastert reported this on his financial disclosure form, but his name does not appear on real estate records. Instead, Kendall County public records show that a Little Rock Trust #225 acquired the property. On his disclosure form, Hastert listed the investment simply as '? share in 69 acres (Plano, IL.),' giving no address or parcel number, as he is required to do by House rules.

Plano is smack dab in the middle of farm country. It is the birthplace of the mechanical reaper. It boasts a population of about 5,000. It's also the town where Hastert has maintained his residence. As farmland those 69 acres were of some value. But as a possible residential site, where the land could be split up and developed, the sky was the limit. And that's what was intended: the Robert Arthur Land Company, through an entity called RALC Plano, was developing a residential community called North County, which would include more than 1,600 acres of land (including Hastert's acreage) as well as 33 acres of commercial enterprises and retail shops. In addition, 18 acres were set aside for a public school.

To create such a large residential community in a rural area, you need roads. Wide roads. The Kendall County Board had already approved the construction of an interchange on nearby Glena Road. But someone had to pay for it.

WE BUILD THE SPEAKER OF THE HOUSE A ROAD

Two months after Speaker Hastert purchased his share in the land, the most powerful man in Congress inserted a $207 million earmark into the federal highway bill to begin building on the Prairie Parkway. An earmark is a way for members of Congress to get money for specific, often local projects. In the words of the White House Office of Management and Budget, it's a way that 'circumvents otherwise applicable merit-based or competitive allocation processes' to make favored projects happen.1

Apparently not content with just a quarter share of 69 acres, a few months later (May 2, 2005) Hastert and his wife transferred an additional 69 acres of land to the Little Rock Trust. Seven months after that (December 7, 2005), a little more than a year after he made the first Plano land purchase, and with the Prairie Parkway in the works, the land was sold for $4.9 million. Land that had been purchased for $15,000 per acre was now sold for $36,000 a acre—a 140% profit.

According to Hastert's personal financial disclosure, these sales amounted to transactions of between $2 million and $10 million for his personal stake. Not a bad return for a short-term investment.2

You and I as taxpayers helped Hastert become wealthy. Involuntarily, of course.

Imagine for a moment that Hastert was not a member of the political class but instead was a corporate executive or a school superintendent. What would happen if he used corporate or county assets in a way that would personally benefit his real estate holdings? If discovered, he would at a minimum get fired. He might even be sued, or charged with criminal fraud. But what Hastert did as a politician is common among the political class.

Members of Congress have used federal earmarks to enhance the value of their own real estate holdings in several ways: by extending a light rail mass transit line near their property, by expanding an airport, or by cleaning up a nearby shoreline. Federal funds have been used to build roads, beautify land, and upgrade neighborhoods near commercial and residential real estate owned by legislators, substantially increasing values and the net worth of our elected officials, courtesy of taxpayer money. Not only is this legal—by the bizarre standards of the Permanent Political Class—it's also deemed 'ethical.' Congressional ethics rules simply say that as long as a member can demonstrate that at least one other person will benefit from an earmark, that earmark is in the 'public interest.' Try out that ethical standard at your job and see how it works for you.

Dennis Hastert represented a rural district in Illinois. The Speaker of the House who followed him, Nancy Pelosi, represents urban San Francisco. Unlike Hastert, Pelosi and her husband have a large stock portfolio. But they also have extensive commercial real estate holdings. And like Hastert, Nancy Pelosi has used federal taxpayer money through earmarks to substantially increase the value of those investments.

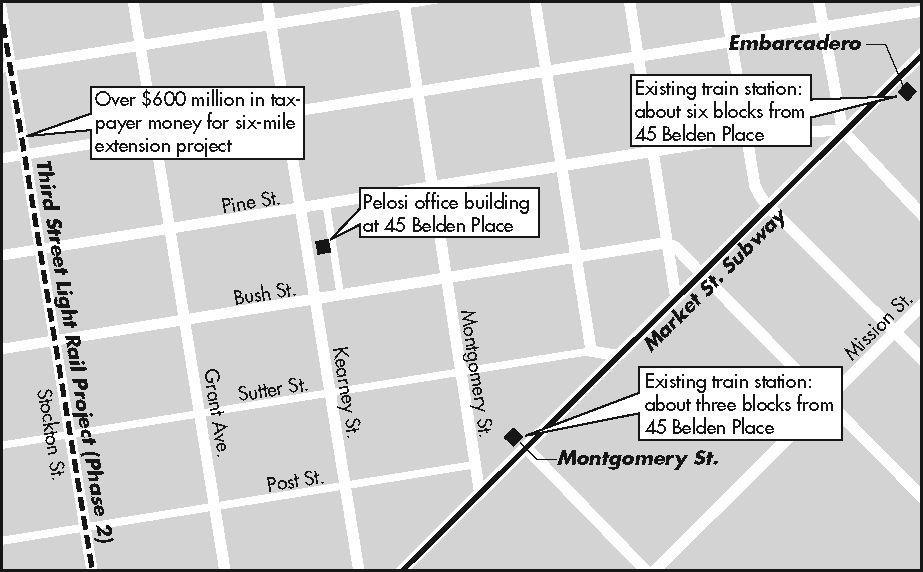

For years, Nancy Pelosi has pushed for earmarks to construct and ultimately extend San Francisco's so-called Third Street Light Rail Project. In 2004, she boasted to her constituents that she had secured more than $120 million in federal money for the project. Third Street is one of the most expensive light rail projects ever, costing $660 million for just a six-mile route. The light rail system includes distinctive marquee poles with sculptures and mobiles, and new street lighting. The rail line is designed to generate a green light at every intersection so trains can travel smoothly from station to station, stopping traffic along the way.

Phase I of the project was heavily funded by the Federal Transit Administration's New Starts program. Pelosi helped secure the funding, to the tune of $532 million, to get the project under way, and another $200 million to continue construction and begin planning for phase two of the project. For the initial $532 million, she actually secured 'cost-effectiveness exemptions' from the federal government to make the deal possible. In 2008, she got an additional $11.7 million to help finance Phase II, and over the course of three years she set aside $28 million more for it.3

The new transit line serves as a 'key infrastructure improvement to help support revitalization of communities along the corridor,' in the words of the San Francisco metro authority. Interestingly enough, that happens to include one of Nancy Pelosi's most valuable real estate assets.4

Pelosi and her husband own a four-story office building at 45 Belden Place. The building is worth between $1 million and $5 million, according to their financial disclosure. Paul Pelosi receives a management fee for handling the property (which he is not required to disclose) on top of net rent of between $100,000 and $1 million per year.

Phase II of the Third Street project runs just two blocks from the Pelosis' commercial buildings. Two stops on the line—Chinatown and Union Square/Market Square—are three blocks from the Pelosis' buildings. Why does this matter? Realtors have a name for it: 'transit premium.' The National Association of Realtors says that high-quality mass transit (like this project) can increase property values by 'over 150 percent.' A $3 million commercial building can become a $7 million building practically overnight.

According to a study by the association, location is key: you don't want the metro stop to be too close or too far. There's a sweet spot for obtaining the maximum transit premium: two to four blocks away is ideal.5

Another study by two academics found that a light rail system in Santa Clara County, California, boosted commercial real estate values by 120%.6

WE BUILD ANOTHER SPEAKER A LIGHT RAIL SYSTEM

Nancy Pelosi seems to have a history of advancing earmarks that are near her family's commercial real estate. (Actually, Pelosi doesn't like to use the word 'earmark.' At a 2007 press conference she said, 'Why don't we leave here today forgetting the word earmark?' She suggested the phrase 'legislative directive' instead.) In 2005, Pelosi pushed for another $20 million earmark, for waterfront redevelopment only two blocks away from the