terrifying closed-door meetings with congressional leaders (two days before the 'ashen-faced' meeting), the stock market had dipped only a few percentage points, and most people assumed that the financial crisis was a disruption that would have just a limited effect on the broader economy. But what Paulson and Bernanke told lawmakers on September 16 made it clear that the public's perception was wrong. Paulson, in his memoir, explains that during the meeting he outlined that the federal government was going to bail out the insurance giant AIG and that the markets were in deep trouble. 'There was an almost surreal quality to the meeting,' he recounts. 'The stunned lawmakers looked at us as if not quite believing what they were hearing.'15

The next day, Congressman Jim Moran, Democrat of Virginia, a member of the Appropriations Committee, dumped his shares in

September 17, 2008, was by far Moran's most active trading day of the year. He dumped shares in Goldman Sachs, General Dynamics, Franklin Resources, Flowserve Corporation, Ecolabs, Edison International, Electronic Arts, DirecTV, Conoco, Procter & Gamble, AT&T, Apple, CVS, Cisco, Chubb, and a dozen more companies.

Moran was just one of many. At least ten U.S. senators, including John Kerry, Sheldon Whitehouse, and Dick Durbin, traded stock or mutual funds related to the financial industry the following day. Representative Shelley Capito is a Republican from West Virginia who sits with Congressman Bachus on the House Financial Services Committee. She and her husband dumped between $100,000 and $250,000 in Citigroup stock the day after the briefing. According to her financial disclosures, she and her husband somehow managed to accrue capital gains from Citigroup stock transactions made throughout the crisis, as much as $50,000 worth.17

Senator Dick Durbin, the Democratic whip and chairman of the Subcommittee on Financial Services and General Government of the Senate Appropriations Committee, attended that September 16 briefing with Paulson and Bernanke. He sold off $73,715 in stock funds the next day. Following the next terrifying closed-door briefing, on September 18, he dumped another $42,000 in stock.18By doing so, Durbin joined some colleagues in saving themselves from the sizable losses that less connected investors would experience. The stock market collapsed shortly after these congressional trades. By October 3, just seventeen days after the September 18 meeting, the market had dropped more than 9%. A month later, it had plummeted over 22%. Preventing a catastrophic loss can be just as important as making a big gain.

Senator Durbin did not just sell stocks based on his inside knowledge. Like Bachus, he was looking for opportunities to invest. Though he sold many of his holdings, he also bought tens of thousands of dollars' worth of Berkshire Hathaway, the holding company run by the legendary investor Warren Buffett. Durbin bought shares on September 19 and 22—more than $60,000 worth. His timing was nearly perfect.

When the House Financial Services Committee was crafting legislation for the TARP bailout of banks in the fall of 2008, eight members of the committee were actively and aggressively trading bank stocks. So too were members of the Senate Finance Committee. As the Treasury Department was conferring over which banks would get the bailout money, Senator John Kerry started buying Citigroup stock. The markets might have been down and in turmoil, but Kerry was buying the troubled company. Lots of it. He purchased up to $550,000 in Citigroup stock in early and mid-October. He also bought up to $350,000 in Bank of America shares.

Members of Congress are privy to all sorts of inside information about pending government actions. Some of it comes from their actual actions—that is, passing legislation. Some of it comes as a result of their position of power. Legislators are told things by regulators or bureaucrats in private because they ask about them. While a committee's public hearings are generally about stagecraft, very frank and detailed conversations often take place behind closed doors. The most valuable information is revealed in private meetings, phone calls, and correspondence. If members of Congress buy and trade stock based on that information, or if they pass that information along to a campaign contributor or their own financial advisers, they are not considered guilty of any wrongdoing. Yes, this is an outrageous standard. But remember, they write their own rules.

Consider for a moment the fact that the political class regularly trades stock in government-backed entities like Fannie Mae and Freddie Mac while

Fannie and Freddie were chartered by Congress, and both have implied government guarantees. For many years, these entities were exempt from the nation's financial disclosure regulations—and politicians traded shares in these companies. Indeed, Fannie and Freddie were even exempt from insider trading rules. And in this murky world, Senate and House members invested with one hand while they exercised oversight with the other.

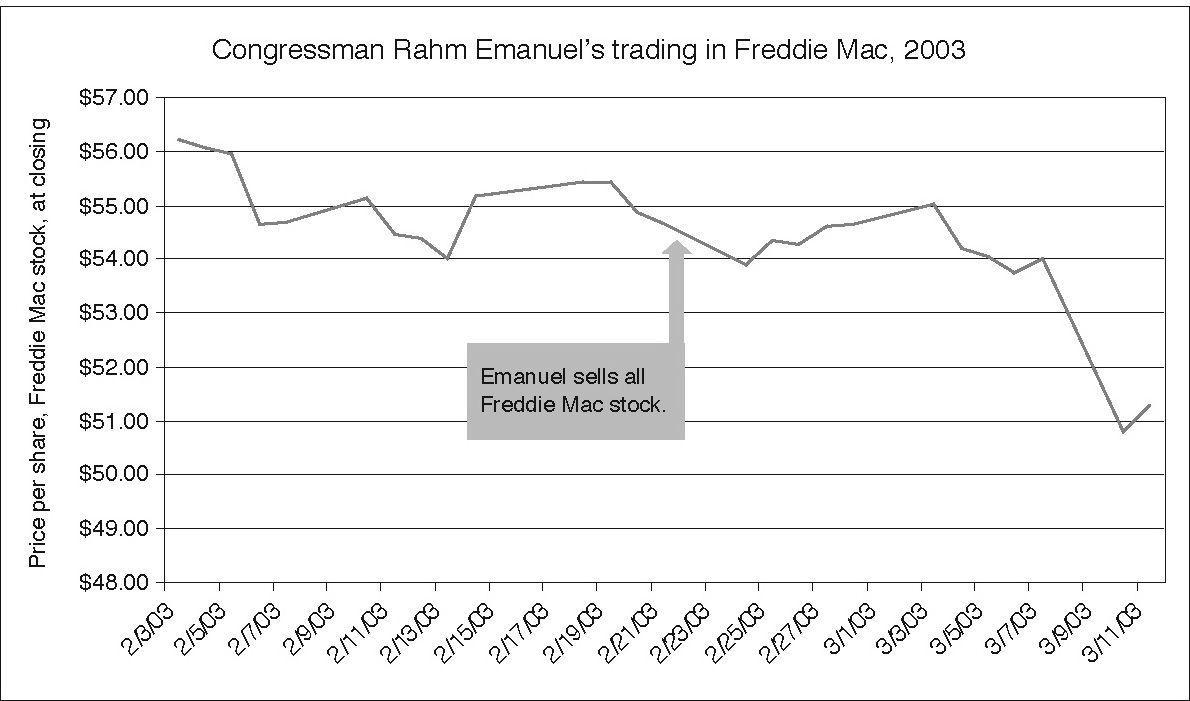

In February 2003, Rahm Emanuel was a newly elected member of Congress from Chicago. He had a seat on the House Financial Services Committee's Subcommittee on Capital Markets, Insurance, and Government-Sponsored Enterprises, which had direct supervision over Fannie and Freddie. Emanuel had previously served on the Freddie Mac board—he'd been appointed by President Clinton in 2000—so he was very familiar with its inner workings. On February 21, Emanuel suddenly sold off all of his Freddie Mac stock, up to $250,000 worth.20 He did so

Were a board member or employee with intimate knowledge of a corporation to dump all of his shares right before an announcement of bad news and a plunge in the stock price, it would at least warrant a look by the SEC. But when a member of Congress does the same thing, he gets a free pass.

The profitability and stock price of Fannie and Freddie have been closely tied to the politics of Washington. On Election Day 2004, when exit polls initially—and wrongly, as it turned out—suggested that John Kerry would win the presidency, Fannie Mae stock markedly rose. When it became clear on November 3 that President Bush had been reelected, Fannie stock opened down and fell sharply for the day, while financial stocks gained overall.21 The reason is simple: George W. Bush was seen as a likely proponent of reforming the government-backed financial giant, whereas Senator Kerry was an opponent of such reforms.

WE KNOW WHAT'S HAPPENING BEFORE YOU DO

There is nothing wrong or unusual about that stock movement, nor anything surprising about the positions taken by Bush and Kerry on the issue. But were those positions influenced by self-interest? For years, Kerry had been an advocate for expanding Fannie Mae's mission, not reforming it.22 He was generally opposed to removing any government guarantees, tightening lending standards, or greater regulatory oversight by Congress. As Kerry was resisting legislative efforts to impose additional regulatory restrictions on the financial giant, he and his wife were quietly selling off their extensive Fannie Mae holdings throughout early 2005.23 Indeed, over a six-month period they dumped around $1 million in Fannie Mae stock. (Again, only ranges were disclosed, not actual figures.) Furthermore, the Kerrys were trading their shares at the same time that the company was telling all of its employees that they could not trade the stock until the new earning results were made public.24 The Kerrys, who had traded Fannie Mae shares for years, dumped the stock before it