below the rate of inflation—in real terms, a cut.

I worked closely with Congress to meet my spending targets—or, as I called it, the overall size of the pie. I didn’t always agree with how Congress divvied up the pieces. I objected to wasteful earmarks inserted into spending bills. But I had no line-item veto to excise pork barrel spending projects. I had to either accept or reject the bills in full. So long as Congress met my bottom line, which it did year after year, I felt that I should hold up my end of the deal and sign the bills.

The results have been a subject of heated debate. Some on the left complain that tax cuts increased the deficits. Some on the right argue that I should not have signed the expensive Medicare prescription drug benefit. It is fair to debate those policy choices, but here are the facts: The combination of tight budgets and the rising tax revenues resulting from economic growth helped drive down the deficit from 3.5 percent of the GDP in 2004, to 2.6 percent in 2005, to 1.9 percent in 2006, to 1.2 percent in 2007.

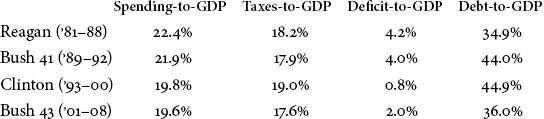

The average deficit-to-GDP ratio during my administration was 2.0 percent, below the fifty-year average of 3.0 percent. My administration’s ratios of spending-to-GDP, taxes-to-GDP, deficit-to-GDP, and debt-to-GDP are all lower than the averages of the past three decades—and, in most cases, below the averages of my recent predecessors. Despite the costs of two recessions, the costliest natural disaster in history, and a two-front war, our fiscal record was strong.

BUDGET COMPARISON TABLE***

At the same time, I knew I was leaving behind a serious long-term fiscal problem: the unsustainable growth in entitlement spending, which accounts for the vast majority of the future federal debt. I pushed hard to reform the funding formulas for Social Security and Medicare, but Democrats opposed my efforts and support in my own party was lukewarm.

Part of the problem was that the fiscal crisis seemed a long way off to the legislative branch while I was in office. In early 2008, the Congressional Budget Office estimated that the debt would not exceed 60 percent of GDP until 2023. But because of the financial crisis—and spending choices made after I left office—debt will exceed that level by the end of 2010. A fiscal crisis that many saw as distant is now upon us.

“Wall Street got drunk, and we got the hangover.”

That was an admittedly simplistic way of describing the origins of the greatest financial panic since the Great Depression. A more sophisticated explanation dates back to the boom of the 1990s. While the U.S. economy grew at an annual rate of 3.8 percent, developing Asian countries such as China, India, and South Korea averaged almost twice that. Many of these economies stockpiled large cash reserves. So did energy-producing nations, which benefited from a tenfold rise in oil prices between 1993 and 2008. Ben Bernanke called this phenomenon a “global saving glut.” Others deemed it a giant pool of money.

A great deal of this foreign capital flowed back to the United States. America was viewed as an attractive place to invest, thanks to our strong capital markets, reliable legal system, and productive workforce. Foreign investors bought large numbers of U.S. Treasury bonds, which drove down their yield. Naturally, investors started looking for higher returns.

One prospect was the booming U.S. housing market. Between 1993 and 2007, the average American home price roughly doubled. Builders constructed homes at a rapid pace. Interest rates were low. Credit was easy. Lenders wrote mortgages for almost anyone—including “subprime” borrowers, whose low credit scores made them a higher risk.

Wall Street spotted an opportunity. Investment banks purchased large numbers of mortgages from lenders, sliced them up, repackaged them, and converted them into complex financial securities. Credit rating agencies, which received lucrative fees from investment banks, blessed many of these assets with AAA ratings. Financial firms sold huge numbers of credit default swaps, bets on whether the mortgages underlying the securities would default. Trading under fancy names such as collateralized debt obligations, the new mortgage-based products yielded the returns investors were seeking. Wall Street sold them aggressively.

Fannie Mae and Freddie Mac, private companies with congressional charters and lax regulation, fueled the market for mortgage-backed securities. The two government-sponsored enterprises bought up half the mortgages in the United States, securitized many of the loans, and sold them around the world. Investors bought voraciously because they believed Fannie and Freddie paper carried a U.S. government guarantee.

It wasn’t just overseas investors who were attracted by higher returns. American banks borrowed large sums of money against their capital, a practice known as leverage, and loaded up on the mortgage-backed securities. Some of the most aggressive investors were giant new financial service companies. Many had taken advantage of the 1999 repeal of the Glass-Steagall Act of 1932, which prohibited commercial banks from engaging in the investment business.

At the height of the housing boom, homeownership hit an all-time high of almost 70 percent. I had supported policies to expand homeownership, including down-payment assistance for low-income and first-time buyers. I was pleased to see the ownership society grow. But the exuberance of the moment masked the underlying risk. Together, the global pool of cash, easy monetary policy, booming housing market, insatiable appetite for mortgage-backed assets, complexity of Wall Street financial engineering, and leverage of financial institutions created a house of cards. This precarious structure was fated to collapse as soon as the underlying card—the nonstop growth of housing prices—was pulled out. That was clear in retrospect. But very few saw it at the time, including me.

In May 2006, Josh Bolten walked into the Treaty Room with a guest he was trying to recruit to the administration, Goldman Sachs CEO Henry Paulson. I hoped to persuade Hank to succeed Secretary of the Treasury John Snow. John had been an effective advocate of my economic agenda, from tax cuts to Social Security reform to free trade. He had done a good job of managing the department and left it in better shape than he’d found it. He had been on the job for more than three years and both John and I felt it was time for a fresh face.

With John Snow.

Josh told me Hank was a hard-charger—smart, energetic, and credible with the financial markets. Hank was slow to warm to the idea of joining my Cabinet. He had an exciting job on Wall Street and doubted he could accomplish much in the final years of my administration. He had a fine reputation and did not want his name dragged through the political mud. He was an avid conservationist who loved to fly-fish for tarpon and watch birds with his wife, Wendy—interests he might not be able to pursue. While Hank was a lifelong Republican, he was a party of one within his family. Wendy was a college friend and supporter of Hillary Clinton’s. Their two children were disillusioned with the Republican Party. I later learned that Hank’s mother cried when she first heard he was joining my Cabinet.

In his steady, low-key way, Josh eventually persuaded Hank to visit with me in the White House. Hank radiated energy and confidence. His hands moved as if he were conducting his own orchestra. He had a distinct way of speaking that could be hard to follow. Some said his brain was moving too fast for his mouth to keep up. That didn’t bother me. People accused me of having the same problem.

Hank understood the globalization of finance, and his name commanded respect at home and abroad. When I assured him he would be my primary economic adviser and have unlimited access, he accepted the offer. I was grateful to Wendy and Hank’s family for supporting him. At the time, none of us realized his tests as treasury secretary would rival those of Henry Morgenthau under FDR or Alexander Hamilton at the founding of the country.

When I took office, I became the fourth president to serve with Federal Reserve Chairman Alan Greenspan. Created under President Woodrow Wilson in 1913, the Fed sets America’s monetary policy and coordinates with other central banks around the world. Its decisions have a wide-ranging impact, from the strength of the dollar to the interest rate on a local loan. While its chairman and board of governors are appointed by the president and confirmed by the Senate, the Fed sets monetary policy independently from the White House and Congress. That’s the way it should be. An independent Fed is a crucial sign of stability to financial markets and investors around the globe.